Make a Gift From My IRA

Search IRA Custodians:

| IRA web page | ||||||||

| Notify us of your IRA charitable rollover | ||||||||

|

||||||||

|

Thank you for considering an IRA charitable rollover gift to us. The website link will take you to your IRA custodian's website, where you may be able to log in and make a gift to the Institute for Creation Research. Another option is to use the phone number to call your IRA custodian. They will assist you in making an IRA charitable rollover gift. If you would like to notify us of your generous IRA charitable rollover, please complete the Notify us of your IRA charitable rollover section. Please note this is a time sensitive transaction. If the IRA charitable rollover is intended to satisfy your required minimum distribution for the current year, verify with your custodian that this transaction will be completed prior to December 31. If the transaction is not completed prior to December 31, you may be subject to penalties if you have not satisfied your required minimum distribution. |

||||||||

| Your Name | ||||||

| Your Address (Street or P.O. Box) | ||||||

| Your ZIP | ||||||

| Notify us of your IRA charitable rollover | ||||||

|

||||||

| Thank you for considering a IRA gift to us. A sample letter is available to send to your DAF provider. You may save and print the PDF of your letter. If you have email contact information for your DAF provider, you may send a PDF copy of your DAF letter or you may copy and paste the text into an email. You will need to enter the amount of your recommended grant and your DAF account number on the letter before mailing. If you would like to notify us of your generous gift, please complete the Notify us of your DAF Gift section. | ||||||

IRA Charitable Rollover

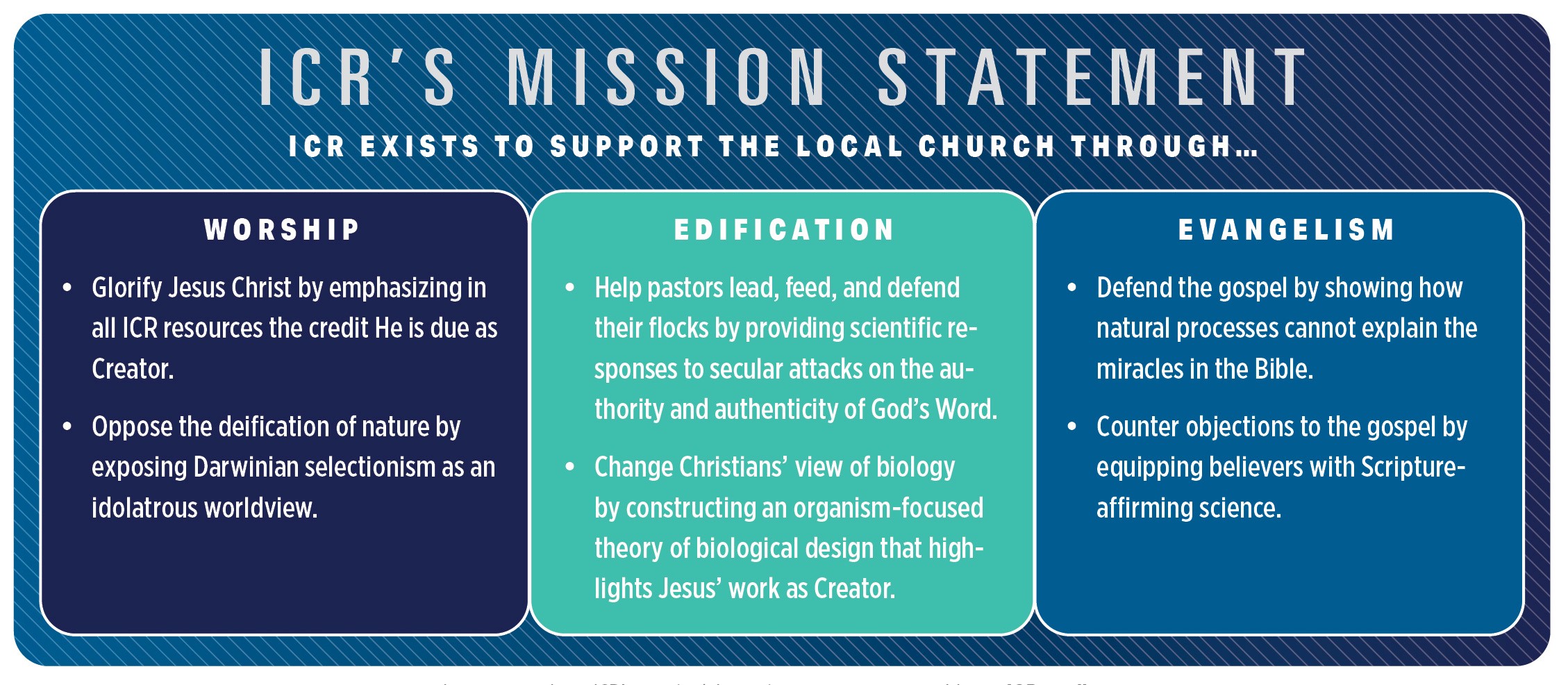

You may be looking for a way to make a big difference and help further ICR's mission. If you are 70½ or older, you may also be interested in a way to lower the income and taxes from your IRA withdrawals.

Benefits of an IRA charitable rollover

- Avoid taxes on transfers from your IRA to ICR.

- May satisfy your required minimum distribution (RMD) for the year.

- Reduce your taxable income, even if you do not itemize deductions.

- Make a gift that is not subject to the deduction limits on charitable gifts.

- Help further the work and mission of ICR.

Please note: A qualified charitable IRA rollover gift must be transferred from a traditional IRA directly to a qualified public charity like ICR and must be completed during the applicable tax year.

How an IRA charitable rollover gift works

- Contact your IRA plan administrator to make a gift from your IRA to us.

- Your IRA funds will be directly transferred to ICR to help continue our important work.

- Please note that IRA charitable rollover gifts do not qualify for a charitable deduction.

- Please contact us if you wish for your gift to be used for a specific purpose.

- Required Minimum Distribution Age - Starting in 2023, the age for required minimum distributions (RMDs) will increase from 72 to 73.

- Catch-Up Contributions - Individuals who are age 50 and older are permitted to make an additional catch-up contribution.

- Required Minimum Distribution Penalty Reduced - Starting in 2023, this penalty will be reduced to 25%. If the plan participant corrects the failure in a timely manner, the excise tax on the penalty is further reduced to 10%.

- Qualified Charitable Distributions Enhanced - The IRA charitable rollover or qualified charitable distribution (QCD) limit of $100,000 for 2023 has been indexed for inflation starting in 2024 to $105,000. Individuals age 70½ or older are permitted to make distributions from their IRA directly to charity and avoid recognition of income. The act expands the QCD by allowing a one-time transfer of up to $53,000 to a charitable remainder annuity trust, standard charitable remainder unitrust or immediate charitable gift annuity in 2024.

To qualify as tax-free, the gift must be distributed directly from the IRA administrator to ICR. If this opportunity is right for you, please contact your IRA administrator and provide the following information.

Federal Identification Number: 95-3523177

Address: 1806 Royal Lane, Dallas, TX 75229

Please advise your administrator to notate the donation with your name and/or your ICR constituent ID number. You can also personally contact ICR to advise us of your contribution, so we can properly acknowledge your donation.

A NEW IRA BENEFIT!

After the passing of the Secure Act 2.0, anyone 70½ or older with an IRA can use their IRA to fund a charitable gift annuity, only once!

IRA to Charitable Gift Annuity Rollover

Section 307 of the Secure 2.0 Act allows a one-time rollover of $53,000 from an IRA to an immediate charitable gift annuity. There can be no additions of other assets. The CGA payouts must either benefit the IRA owner or the IRA owner and spouse.

The bill permits an inflation adjustment starting in 2024. The $105,000 limit for current IRA rollover gifts (QCDs) and the $53,000 one-time QCD limit for gifts to a life income plan will be adjusted for inflation. The new numbers will be rounded to the nearest thousand dollars. Although the opportunity to fund a CGA with a QCD is a one-time provision, donors will enjoy the fixed lifetime payments at favorable fixed rates. First-time IRA rollover to CGA donors may become repeat CGA donors using other funding sources.

The new CGA rates:

| One-Life CGA | Two-Life CGA | |||

|---|---|---|---|---|

| Age | Rate | Payment | Rate | Payment |

| 70 | 6.3% | $1,260 | 5.5% | $1,100 |

| 75 | 7.0% | $1,400 | 6.2% | $1,240 |

| 80 | 8.1% | $1,620 | 6.9% | $1,380 |

| 85 | 9.1% | $1,820 | 8.1% | $1,620 |

| 90 | 10.1% | $2,020 | 9.8% | $1,960 |

| Rates Effective January 1, 2024 | ||||

Contact us

Thank You

Your message has been sent.

.png)