Charitable Gift Annuity

You may be tired of living at the mercy of the fluctuating stock and real estate markets. A charitable gift annuity is a gift made to our ministry that can provide you with a secure source of fixed payments for life.

Benefits of a charitable gift annuity

- Receive fixed payments to you or another annuitant you designate for life

- Receive a charitable income tax deduction for the charitable gift portion of the annuity

- Benefit from payments that may be partially tax-free

- Further the charitable work of the Institute for Creation Research with your gift

How a charitable gift annuity works

A charitable gift annuity is a way to make a gift to support the Institute for Creation Research.

- You transfer cash to the Institute for Creation Research.

- In exchange, we promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

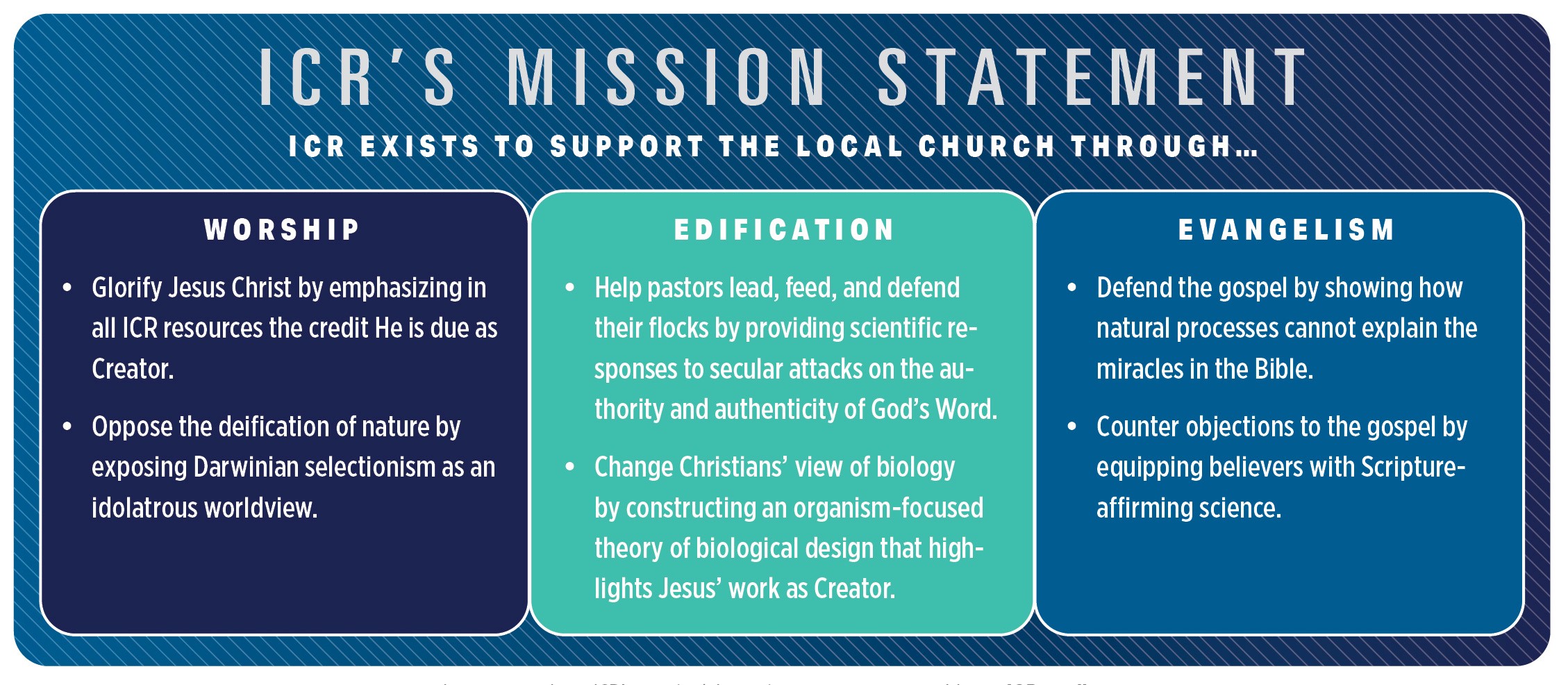

- You also receive satisfaction, knowing that you will be helping further our mission.

NOW you can use an IRA Rollover to fund a Charitable Gift Annuity.

The Secure Act 2.0 was included in the Consolidated Appropriations Act, 2023 (H.R. 2617). It includes many changes that could enhance and facilitate retirement benefits. Section 307 of the Secure 2.0 Act allows a one-time rollover of $53,000 from an IRA to a life income plan. This provision amends Internal Revenue Code Section 408(d)(8) and creates a limited one-time IRA rollover into certain qualified life income plans. This qualified charitable distribution (QCD) of up to $53,000 is permitted on or after January 1, 2023.

The $53,000 IRA distribution may be to a standard payout charitable remainder unitrust (CRUT) or immediate charitable gift annuity (CGA). A net income plus makeup unitrust or a deferred payment gift annuity are not qualified charitable entities.

For a charitable gift annuity, it must have a 5% or higher payout rate and be qualified under Section 501(m)(5)(B). Some two-life gift annuities with the IRA owner over age 70½ and a spouse under age 62 may need to increase the payout from the ACGA recommended rate to 5% in order to qualify.

The bill permits an inflation adjustment starting in 2024. The $105,000 limit for current IRA rollover gifts (QCDs) and the $53,000 one-time QCD limit for gifts to a life income plan will be adjusted for inflation. The new numbers will be rounded to the nearest thousand dollars. The outright QCD must be a transfer from the IRA custodian to a qualified nonprofit and may not be to a donor-advised fund or supporting organization.

Here are benefits to using your IRA to fund a CGA.

- You can avoid the tax hit coming when you make a typical withdrawal from your IRA.

- For required minimum distributions, you can satisfy all or part of that obligation for the year.

- Receive income for life in the form of reliable payments.

- Annuity payments are fixed, regardless of the stock market, interest rates, or inflation.

- Once you go home to glory, the remaining balance becomes your legacy to fund our ministry at the Institute for Creation Research.

If you decide to fund your gift annuity with cash, a significant portion of the annuity payment will be tax-free. You may also make a gift of appreciated securities to fund a gift annuity and avoid a portion of the capital gains tax. Please contact us to inquire about other assets that you might be able to use to fund a charitable gift annuity.

Contact us

If you have any questions about charitable gift annuities, please contact us. We would be happy to assist you and answer your questions.

.png)